The Institute of Economic Affairs has accused the Bank of actually helping to increase inflation across the country - the opposite of what it is trying to achieve with rate hikes. The Bank of England is at risk of "overcorrecting" the UK's inflation problem, a right-wing thinktank has said after this afternoon's decision to hike interest rates to 4.5%. This, he said, is due to the global super-rich being worried about the prospect of Labour winning the next general election - as they have pledged to scrap a tax loophole for non-doms.Ī report released last year said super-rich people resident in the UK and registered as having non-domicile status with a permanent home outside the country are able to avoid paying more than £3.2bn in tax in total on at least £10.9bn of offshore income a year. Paddy Dring, the global head of prime sales at Knight Frank, said London is "still highly regarded by global buyers" - but he expected super-prime sales to drop by at least 10% over the next year. The previous year, £2.5bn was spent on 144 properties. This is the most since 2016, when the world's mega-rich were spooked from investing in the UK's "super-prime" market by Brexit.Ī total of £3.1bn was spent on the properties, working out to an average of just over £19m per sale.

More than 160 properties worth £10m or more were sold in the capital over the past year to March, according to analysis by estate agent Knight Frank and data provider LonRes.

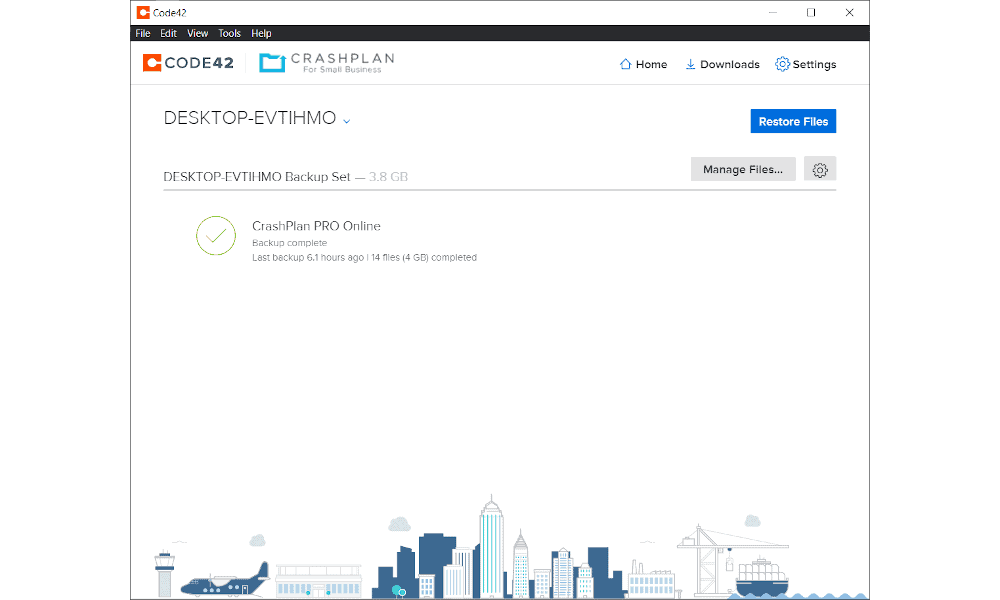

:max_bytes(150000):strip_icc()/crashplan-pro-security-settings-599ed655c412440013686e8e.png)

While most of the country is struggling with the cost of living crisis, sales of London's most expensive homes have returned to pre-pandemic levels.

0 kommentar(er)

0 kommentar(er)